STRATEGIC PLANNERS

Our planning process has taken a new turn. We have had plans before, most notably a "Road Map" to victory, from our former director from Ohio, Steve Curtis. Steve's plan was detailed and well thought through. The problem was that we needed funds to implement it. In the meantime, social media developments have overtaken many aspects of Steve's plan.

Our former director, Phil Hinson, had been pressing for an in-person workshop with a paid facilitator to develop a plan. Such a plan would emerge with buy-in from a wide range of constituents. Again, funding was the issue, and the exercise may have been too elaborate.

Last year, our FAIRtax Washington volunteer, Rich Germaine, circulated a twelve-slide plan to present to contributors, which resulted in a donation to fund a survey. This time, Rich started a planning group, but other matters prevented him and David Morelli from continuing. We thank Rich and David for their service and regret seeing them go. Rich and Dave said they will continue supporting the FAIRtax in other ways.

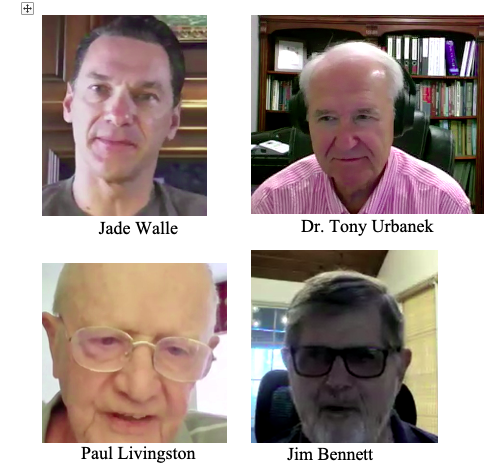

The new team leader is our returning Board member, Jade Walle, CPA. Jade recently retired from his position as a partner in a Big Four public accounting firm and can now focus his energies on the cause he most believes in, the FAIRtax.

Another team member is Dr. Tony Urbanek, an entrepreneur, medical doctor, and Board member who leads our efforts in Tennessee. Recently, Tony brought the Tennessee Legislature to pass a resolution supporting the FAIRtax and urging Congress to pass it.

Team member Paul Livingston, our Florida State Director, has recently secured funding for Rich Germain's Quantus survey. The survey is the strongest argument we have for the political viability of the FAIRtax.

Yours Truly is the fourth team member.

We purposefully kept the team small to allow frequent and extensive discussion of issues at meetings. However, we embrace input from all FAIRtax supporters. If you have an idea you would like the team to consider, please get in touch with Jade Walle at (713) 582-9966, jadelondon1@hotmail.com.

And yes, we have a game plan. After presenting it to the Board, we will present it in Grassroots Corner.

The plan can always be revised. So, if you have any ideas for the plan, I would love to consider them for a future Grassroots Corner.

Our former director, Phil Hinson, had been pressing for an in-person workshop with a paid facilitator to develop a plan. Such a plan would emerge with buy-in from a wide range of constituents. Again, funding was the issue, and the exercise may have been too elaborate.

Last year, our FAIRtax Washington volunteer, Rich Germaine, circulated a twelve-slide plan to present to contributors, which resulted in a donation to fund a survey. This time, Rich started a planning group, but other matters prevented him and David Morelli from continuing. We thank Rich and David for their service and regret seeing them go. Rich and Dave said they will continue supporting the FAIRtax in other ways.

The new team leader is our returning Board member, Jade Walle, CPA. Jade recently retired from his position as a partner in a Big Four public accounting firm and can now focus his energies on the cause he most believes in, the FAIRtax.

Another team member is Dr. Tony Urbanek, an entrepreneur, medical doctor, and Board member who leads our efforts in Tennessee. Recently, Tony brought the Tennessee Legislature to pass a resolution supporting the FAIRtax and urging Congress to pass it.

Team member Paul Livingston, our Florida State Director, has recently secured funding for Rich Germain's Quantus survey. The survey is the strongest argument we have for the political viability of the FAIRtax.

Yours Truly is the fourth team member.

We purposefully kept the team small to allow frequent and extensive discussion of issues at meetings. However, we embrace input from all FAIRtax supporters. If you have an idea you would like the team to consider, please get in touch with Jade Walle at (713) 582-9966, jadelondon1@hotmail.com.

And yes, we have a game plan. After presenting it to the Board, we will present it in Grassroots Corner.

The plan can always be revised. So, if you have any ideas for the plan, I would love to consider them for a future Grassroots Corner.

---------------------------------------------------------

WE'VE GOT YOU COVERED – IF YOU LET US KNOW.

WE'VE GOT YOU COVERED – IF YOU LET US KNOW.

As a reminder, event insurance coverage is available, but you must let us know. Once the event is underway, it's too late. If you are planning an event, please provide me with the who, what, when, and where, and I will get you a certificate of insurance.

---------------------------------------------------------

TAKE BACK CONTROL!

TAKE BACK CONTROL!

[i] Florida does not belong to the handful of states that sponsor disability insurance benefits and deduct that cost from payroll.

[ii] Florida Budget Report for 2025-2026.

[iii] Tuerck, Bachmann, Jacob, “Fiscal Federalism: The National FairTax and the States,” The Beacon Hill Institute, September 2007, at p. 17, Table 3.

[1] You can design your own business card. I had mine printed at https://www.vistaprint.com. Here’s mine. Please clear your design first with our Marketing and Communications Team Leader, Randy Fischer, randy.fischer@fairtax.org. Randy turns requests around quickly. We need to know where our logos and service marks are going.

[i] You can design your own business card. I had mine printed at https://www.vistaprint.com. Here’s mine. Please clear your design first with our Marketing and Communications Team Leader, Randy Fischer, randy.fischer@fairtax.org. Randy turns requests around quickly. We need to know where our logos and service marks are going.

[i] The nine jurisdictions with statewide sales taxes but no local sales taxes are Connecticut, Indiana, Kentucky, Maryland, Massachusetts, Michigan, New Jersey, Rhode Island, and the District of Columbia.

[ii] Tax Foundation: https://taxfoundation.org/data/all/state/2024-sales-taxes/

[iii] Ibid.

[iv] Fiscal Federalism: The National FairTax and the States, Tuerck, Bachman, and Jacob, The Beacon Hill Institute, September 2007, see the chart at p. 17.

[1] The average rates expressed as a percentage of AGI within each jurisdiction are: AL--0.10%; DE--0.16%; IN--0.62%; IA--0.11%; KY--1.33%; MD--2.40%; MI--0.17%; MO--0.22%; NY--1.63%; OH--1.57%; PA--1.23%. In CA, CO, KS, NJ, OR, and WV some jurisdictions have payroll taxes, flat-rate wage taxes, or interest and dividend income taxes. See Andrey Yushkov, Tax Foundation “State Individual Income Tax Rates and Brackets, 2024” February 2024; https://taxfoundation.org/data/all/state/state-income-tax-rates-2024/l See also Jared Walczak, Janelle Fritts, and Maxwell James, “Local Income Taxes: A Primer,” Tax Foundation, February 23, 2023, https://taxfoundation.org/local-income-taxes-2023/.

AFFT Grassroots Coordinator & Secretary

🇺🇸 Call For Pictures & WriteUps - We need more of you to send in pictures and news. If you have something to share, please send your material to me, Jim.Bennett@FAIRtax.org, (908) 578-4975, or fax (908) 598-2888. When others see your activity, they are inspired, and the process snowballs. When the process snowballs, Congress Members, Senators, and even the President start to listen.

🇺🇸 The Official FAIRtax Store - Don’t forget to order your FAIRtax gear from the FAIRtax Store.