MARK SCHAFF PUTS GROK AI TO THE TEST – FINAL PART THRE

Mark and Cyndi Schaff

Our FAIRtax Leader in South Carolina, Mark Schaff, put Grok to the test and sent in the results. Grok claims to be a free AI assistant designed by xAI that says it maximizes truth and objectivity. It states that it offers real-time search, image generation, trend analysis, and more. Let’s see how well it measured up to those goals.

Mark is considering using ChatGPT and other tools to compare their responses with Grok's. Here is what came back from Grok with some editorial remarks showing that the human hand is still needed.This is the last of a multi pot series on Grok and other forms of AI.

Last time we reported on Grok’s first three perspectives on the FAIRtax that it “believes” are the negatives. This is the third and final of a multi-part series on Grok and other forms of AI.

Mark is considering using ChatGPT and other tools to compare their responses with Grok's. Here is what came back from Grok with some editorial remarks showing that the human hand is still needed.This is the last of a multi pot series on Grok and other forms of AI.

Last time we reported on Grok’s first three perspectives on the FAIRtax that it “believes” are the negatives. This is the third and final of a multi-part series on Grok and other forms of AI.

-------------------------------

Potential Negative Impacts

…

4. Transition Challenges:

- The shift to a consumption-based tax could disrupt after-tax savings, state and local bond tax advantages, and industries reliant on tax deductions, potentially causing short-term economic declines. A 2000 Nathan Associates study predicted a 3-year GDP decline, 4-year employment drop, and 8-year reduction in consumer spending under a similar proposal. (https://en.wikipedia.org/wiki/Predicted_effects_of_the_FairTax)

Ed: The FAIRtax enables savers to save and invest their earnings tax-free, making the discussion about pre-tax and after-tax earnings irrelevant. State and local bond interest rates are lower today only because they are exempt from federal income taxes. Without federal income taxes, state and local bonds will pay similar rates to commercial paper but enjoy a broader class of potential buyers.

The housing industry is dependent on the mortgage interest and SALT deductions. The SALT deduction was recently reduced and later temporarily and partially reinstated. The FAIRtax is not just a mortgage interest and SALT deduction. It adds a “deduction” for mortgage principal, down payment, and capital gain because it does not tax income needed to pay mortgage principal, down payments, and capital gains in the first place. And the FAIRtax turns around and does the same for FICA taxes, which do not exempt principal, down payments or capital gains.

The Nathan Associates study cited by Grok is not the only study available. See “Simulating the Dynamic Macroeconomic and Microeconomic Effects of the FairTax,” Jokisch and Kotlikoff, 2005, concluding, “… the FairTax offers a real opportunity to improve the U.S. economy's performance and the wellbeing of the vast majority of citizens.” See also “The Economic Effects of the FairTax: Results from the Beacon Hill Institute CGE Model,” Tuerck, Haughton, Bhattarai, Ngo, Sanches-Penalver, The Beacon Hill Institute, 2007. This paper concludes that real GDP, domestic investment, capital stock, employment, real wages, and consumption all benefit from the FAIRtax.

- States would bear new administrative burdens, and the 0.25% administrative fee may not cover costs, raising concerns about feasibility. (https://www.portebrown.com/newsblog-archive/demystifying-fair-tax-proposals)

Ed: This conclusion defies common sense. Sales taxes are simple to administer. In addition to states, retail merchants receive 0.25% for their trouble, and states receive 0.25% for simply receiving the tax and remitting it timely to the federal Sales Tax Bureau.

5. Social Program Funding:

- The FairTax allocates 64.83% of revenue to general funds, 27.43% to Social Security, and 7.74% to Medicare in the first year, but critics question long-term solvency for these programs due to potential revenue shortfalls. (https://taxpolicycenter.org/briefing-book/what-fair-tax) (https://www.americanprogress.org/article/the-fair-tax-act-would-radically-restructure-the-nations-tax-system-in-favor-of-the-wealthy/)

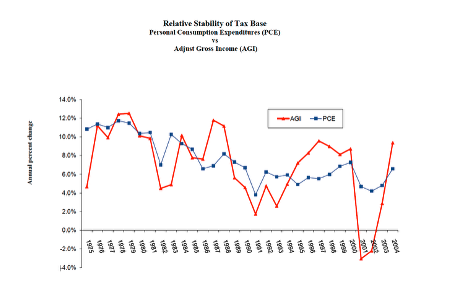

Ed: Social Security and Medicare are already facing insolvency. Benefits will drop 21% in 2023 if Congress fails to act now. Switching the funding base for these vital programs from payroll to consumption assures a more stable and growing base. The following graph shows that the volatility of personal consumption is far less than adjusted gross income, which tracks closely with payroll.

Mixed and Uncertain Effects

- Charitable Giving**: A 2007 Beacon Hill study suggested charitable giving could increase under the FairTax, particularly for religious organizations, but educational, health, and cultural charities might see declines due to shifts in donor preferences. (https://en.wikipedia.org/wiki/Predicted_effects_of_the_FairTax)

Ed: History has shown that giving is more a function of how much money people have in their pockets to give than tax incentives. Following the Reagan tax cuts, for example, there was concern that giving would plummet because Reagan had reduced the top tax rates. Instead, giving reached an all-time high following his tax rate cuts.

- Labor and Wages: Estimates suggest real wages could rise by 10.2%–18.9% over time due to increased labor productivity and reduced tax burdens on income, but short-term price increases could offset these gains for consumers. (https://en.wikipedia.org/wiki/Predicted_effects_of_the_FairTax)

Ed: Grok is correct that real wages will rise, but short-term price increases are far less certain. According to a 2006 paper in Tax Analysis, “Taxing Sales Under the FairTax: What Rate Works?” Bachman, Haughton, Kotlikoff, Sanchez-Penalver, Tuerck, beginning at p. 669, the article states, “… at a macroeconomic level, prices depend on how the monetary authorities react to changes in tax policy, macroeconomic conditions, and other variables affecting prices. A rise in the price level would be possible only if accommodated by the money supply.”

In other words, if the Fed doesn’t print money, there will be no inflation under the FAIRtax.

- Political Feasibility: The FairTax lacks broad support, with only 24 co-sponsors in 2023 (down from 83 in earlier years) and opposition from key Republican leaders like Kevin McCarthy. It faces near-certain failure in the Senate, limiting its immediate economic impact. (https://www.factcheck.org/2023/01/democrats-misleadingly-suggest-widespread-gop-support-for-fairtax-bill-unlikely-to-become-law/)[](https://mac.ncsu.edu/2023/02/09/the-pros-and-cons-of-the-proposed-fair-tax-act-of-2023/)

Ed: The FAIRtax movement needs more public education. However, the recent attack by Democrats at a Tax Subcommittee hearing of the House Ways and Means Committee shows that the FAIRtax has moved beyond Gandhi’s first two stages of being ignored and then ridiculed. A recent Quantus survey shows that Americans from both political parties and unaffiliated Americans favor a national sales tax over the current income tax system. Support is greater than Grok thinks.

Conclusion

The FairTax Act could stimulate long-term economic growth by encouraging investment and simplifying taxation, but it risks short-term price shocks, regressivity, and revenue shortfalls. Its high sales tax rate may disproportionately burden lower-income households, and transition challenges could disrupt the economy. While proponents highlight transparency and efficiency, critics argue it’s unworkable without significant adjustments to the tax rate or government spending. The bill’s low political traction suggests limited near-term impact. (https://www.americanactionforum.org/research/evaluation-and-macroeconomic-impact-of-the-fairtax/) (https://www.brookings.edu/articles/proposed-fairtax-rate-would-add-trillions-to-deficits-over-10-years/) (https://www.brookings.edu/articles/deconstructing-the-fair-tax/)

Ed: See the previous discussions here and in Grassroots Corner for October 20, 2025.

For further details, review the bill at https://www.congress.gov or analyses at (https://www.brookings.edu) or (https://fairtax.org) (https://www.congress.gov/bill/119th-congress/house-bill/25) (https://www.brookings.edu/articles/deconstructing-the-fair-tax/).

-------------------------

Here is the editor back with a true cautionary story about Artificial Intelligence. AI can be a great tool, but always check your sources. Here’s why:

There once was an attorney who decided to let another AI platform, ChatGBT, write his legal brief for him to submit to the judge. He submitted the brief to the court without checking his sources. It turns out that all the cases he cited in his brief were fake, even though they looked impressively real. The attorney came clean and admitted his shortcomings. But imagine having to answer to the judge, the client, and the ethics board!

Use AI as a tool, but use it wisely.

I would love to hear about your experiences using AI for the FAIRtax.

---------------------------------------------------------

WE'VE GOT YOU COVERED – IF YOU LET US KNOW.

WE'VE GOT YOU COVERED – IF YOU LET US KNOW.

As a reminder, event insurance coverage is available, but you must let us know. Once the event is underway, it's too late. If you are planning an event, let me know the who, what, when, and where, and I will get you a certificate of insurance.

---------------------------------------------------------

TAKE BACK CONTROL!

TAKE BACK CONTROL!

[i] Florida does not belong to the handful of states that sponsor disability insurance benefits and deduct that cost from payroll.

[ii] Florida Budget Report for 2025-2026.

[iii] Tuerck, Bachmann, Jacob, “Fiscal Federalism: The National FairTax and the States,” The Beacon Hill Institute, September 2007, at p. 17, Table 3.

[1] You can design your own business card. I had mine printed at https://www.vistaprint.com. Here’s mine. Please clear your design first with our Marketing and Communications Team Leader, Randy Fischer, randy.fischer@fairtax.org. Randy turns requests around quickly. We need to know where our logos and service marks are going.

[i] You can design your own business card. I had mine printed at https://www.vistaprint.com. Here’s mine. Please clear your design first with our Marketing and Communications Team Leader, Randy Fischer, randy.fischer@fairtax.org. Randy turns requests around quickly. We need to know where our logos and service marks are going.

[i] The nine jurisdictions with statewide sales taxes but no local sales taxes are Connecticut, Indiana, Kentucky, Maryland, Massachusetts, Michigan, New Jersey, Rhode Island, and the District of Columbia.

[ii] Tax Foundation: https://taxfoundation.org/data/all/state/2024-sales-taxes/

[iii] Ibid.

[iv] Fiscal Federalism: The National FairTax and the States, Tuerck, Bachman, and Jacob, The Beacon Hill Institute, September 2007, see the chart at p. 17.

[1] The average rates expressed as a percentage of AGI within each jurisdiction are: AL--0.10%; DE--0.16%; IN--0.62%; IA--0.11%; KY--1.33%; MD--2.40%; MI--0.17%; MO--0.22%; NY--1.63%; OH--1.57%; PA--1.23%. In CA, CO, KS, NJ, OR, and WV some jurisdictions have payroll taxes, flat-rate wage taxes, or interest and dividend income taxes. See Andrey Yushkov, Tax Foundation “State Individual Income Tax Rates and Brackets, 2024” February 2024; https://taxfoundation.org/data/all/state/state-income-tax-rates-2024/l See also Jared Walczak, Janelle Fritts, and Maxwell James, “Local Income Taxes: A Primer,” Tax Foundation, February 23, 2023, https://taxfoundation.org/local-income-taxes-2023/.

AFFT Grassroots Coordinator & Secretary

🇺🇸 Call For Pictures & WriteUps - We need more of you to send in pictures and news. If you have something to share, please send your material to me, Jim.Bennett@FAIRtax.org, (908) 578-4975, or fax (908) 598-2888. When others see your activity, they are inspired, and the process snowballs. When the process snowballs, Congress Members, Senators, and even the President start to listen.

🇺🇸 The Official FAIRtax Store - Don’t forget to order your FAIRtax gear from the FAIRtax Store.