THE EVASION STUDY THAT EXPOSES THE INCOME/PAYROLL TAX

The National Tax Research Committee has approved the release by Americans For Fair Taxation of the study entitled Estimated Future Tax Evasion under the Income Tax and Prospects for Tax Evasion under the FairTax: New Perspectives. This study was done by Richard J. Cebula, Ph.D.,

Walker/Wells Fargo Endowed Chair in Finance, Jacksonville University and Fiorentina Angjellari-Dajci, Ph.D., Florida State College at Jacksonville, Florida.

Here are some of the major conclusions from the study:

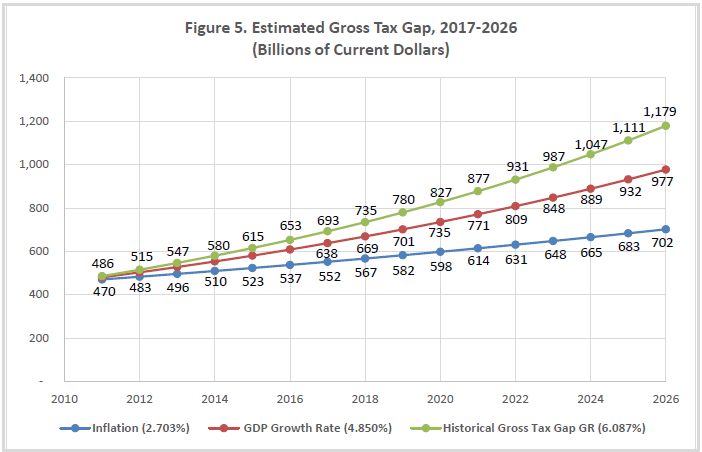

- Total tax evasion (all federal taxes) will increase from an estimated 20.2% in 2017 to 23.6% in 2026 of gross tax revenues by 2026.

- Total evasion from the federal income tax system over the next decade (2017-2026) based on historical trends will reach about 9 trillion dollars.

- Individual Income Tax evasion from 2017 to 2026 will persist above the 16% level. Based on historic growth rates (which is the more likely to occur scenario), income tax evasion will grow from 29.3% of income tax revenues in 2017 to 34.2% by 2026 – exceeding one third of income tax revenues.

- To enable the federal government to raise the same level of revenue it would collect if all taxpayers were to report their income and pay their taxes in full, the income tax system, in effect, assesses the average household an annual “surtax” that varies from $4,276 under the most conservative scenario, to $8,526 based on the more likely to occur historical evasion trends.

- The cumulative tax burden shifted from tax scofflaws to compliant taxpayers amounts to a total estimated burden of between $46,623 and $68,328 over the ten-year period from 2017-2026, which is comparable in size, if not greater, under the third scenario, to both the median and mean household income in the U.S. in 2015.

- In other words, in one out of the 10 years ahead each American household will be working solely to pay off the 10-year overall “surtax”—arguably a heavy burden for every household.

This landmark study clearly establishes that the income/payroll tax system is heading for a cliff. We have repeatedly warned that evasion is increasing. All of us see it every day. We know that the nature of the work force is no longer primarily employer-employee but already in excess of 35% non-traditional workers who either have several jobs or are independent contractors. This was extensively discussed in the December 2, 2016 FAIRtax newsletter.

How long are people who are paying their income/payroll taxes going to tolerate paying to support the people who have chosen to not pay their share of income/payroll taxes? How long will the growing number of non-traditional workers, who are paying the correct amount of income/payroll taxes, continue to pay when they see their neighbors and friends keeping more of their money by evading taxes?

To those of us who are horrified by many of the IRS abuses, are we really interested in Congress authorizing and funding the hiring of armies of IRS auditors who will harass all of us as they seek to catch the people who are evading the income/payroll tax? Many in D.C. may say, “Why are you concerned? If you haven’t done anything wrong then what do you care?”

The answer lies in the absurdity of the income tax law and the way that the IRS has worked. There are few absolute certainties in the Internal Revenue Code. Was it a business dinner or a business trip? Do you have what the IRS considers the required records to justify the deduction? Audits take time and many of us will be involved in a very time-consuming and often costly process, if we employ accountants or attorneys to help us.

At the end of the day, we will all be forced to suffer through the futile attempt to stop the sinking income/payroll tax system. What the D.C. elites don’t recognize is that people subjected to arbitrary actions by IRS auditors will rebel. How do they rebel? They often find ways to evade the income/payroll tax and justify this by pointing to the abusive IRS actions.

WHAT YOU MUST DO

It is vital that each of us ensure that the Cebula study is delivered to every Member of Congress and is sent to President Trump. Please download and print the study and deliver it to the local office of your Member of the House of Representatives and each of your two Senators. If you cannot deliver it, then ask a friend that lives near these representatives to deliver them to the office.

Once they have been delivered, then it is necessary for you to follow up to ensure that the study has been shown to the Member and then to demand to know what the Member is going to do about this. Are they simply going to fund armies of IRS agents who try to coerce compliance with the income/payroll tax? Or are they willing to look at real tax reform—H.R. 25 or S.B. 18, The FAIRtax?

The choice is simple. Either your Member is agreeable to people cheating and demanding that you pay for the evaders or to hiring armies of IRS agents to perform intrusive audits.

DON’T MISS YOUR CHANCE TO HELP BRING ABOUT REAL TAX REFORM

Abraham Lincoln also said, “Things may come to those who wait, but only the things left by those who hustle.”

We may only have a limited time to stop the fake tax reform being promoted by some in Congress. If it passes, then the Elites will say that we need to wait before we consider any more changes. To stop this fake reform, we must be able to ensure that our message is clearly heard not only by Congress but also by President-elect Trump. To do this we need your help.

By contributing (investing) $10.40 per month, you help provide a financial base to AFFT. If you can make larger contributions (investments), these will be used not for salaries, as we are all volunteers, but for the needed updates to our economic studies which will be vital in 2017.

Please go to this link to invest in AFFT and in your and your family’s future.

FAIRtax E-Book

AMERICA’S BIG SOLUTION - An E-book For Beginners

To all things, there is a beginning and an end. The end is when HR 25, The Fair Tax Act of 2017 becomes law. If someone needs to start from the beginning with the FAIRtax, this e-book is what they need. We all need to become engaged in order to force Congress and President Trump to adopt the FAIRtax as the new tax plan. We all need to come up to speed on the FAIRtax. This e-book is the first step.

AMERICA'S BIG SOLUTION is available for only $2.99 for the Amazon Kindle, the Barnes & Noble Nook and Apple iOS.

AMERICA'S BIG SOLUTION by Florida Volunteer Terry Tibbetts has been written to give people of all ages a basic introduction to the FAIRtax and encourage them to learn more about the most thoroughly researched tax plan ever presented to Congress. It is a light hearted approach to a very serious subject.

Everyone needs to know that we have an alternative to federal income tax and the criminal enterprise known as the IRS. Everyone needs hope and AMERICA'S BIG SOLUTION provides that hope. AMERICA'S BIG SOLUTION is an alternative the social media platforms competing for our attention.

You can even purchase a print copy at the same Amazon link above for $9.25. Regardless of whether you choose the electronic format or the print format, you'll find AMERICA'S BIG SOLUTION will give someone the boost they need to begin their study of the FAIRtax and the suggested resources to learn more. Buy AMERICA'S BIG SOLUTION now!

FAIRtax Power Radio

Weekly Podcasts and Monthly Facebook LIVE

The next Facebook LIVE event for FAIRtax Power Radio will be held in just a few days - Monday, March 6 at 8 PM ET. You can become part of the event. It’s free and it’s LIVE so you can interact with us and get an immediate response. The February LIVE event was quite successful and this one will be even better. This month’s Event will be hosted by the Americans For Fair Taxation on their Facebook page: https://www.facebook.com/FairTax/ Sign up for the Event at this LINK.

Of course we still do our free weekly podcast just for you. A new podcast is posted every Friday morning.

Through the “Hope and Change” of the last eight years and the promises to “Make America Great Again,” what is Congress and the new administration offering us as tax reform? At this point, both President Trump and the Speaker Ryan are offering a modification of the current failed system. As Kerry Bowers, one of The FAIRtax Guys interviewees, said about Speaker Ryan’s “A Better Way” plan, “It transforms the tax plan from a personal income tax, a corporate income tax and a payroll tax enforced and administered by the IRS to a system that includes a personal income tax, a corporate income tax and a payroll tax enforced and administered by the IRS.” Is this REAL reform? No!

As The FAIRtax Guys discuss, this plan does not represent “Hope and Change” and is not the way to “Make America Great Again.” We need true tax reform; we need the FAIRtax. And we provide the listener new and novel ways to discuss the FAIRtax with your friends and neighbors every week.

You can listen to our FREE podcasts on Spreaker.com, iTunes or iHeart Radio. You can listen on line or download the podcasts to your computer or smartphone.

For your iPhone or Android, we have a free app. Just search for FAIRtax Power Radio in your app store, download the app and start listening. We post a new episode every Friday morning. Please listen in and tell everyone you know about the FAIRtax Power Radio podcasts.

Links for Further Information

Please, if you'd like to keep studying and promoting the FAIRtax, make yourself familiar with the links below. We always do our best to keep our AFFT community up to date, and you can stay ahead of the curve using these convenient sites.

- The website of Americans for Fair Taxation

- The FAIRtax website at which you can get involved to help make it happen.

- The Facebook page for Americans for Fair Taxation

- The Facebook page for The FAIRtax Guys

- The Twitter page for Americans for Fair Taxation

- PopVox - Connecting people and lawmakers for more effective participation and better governing

- YouTube channel for AFFT

- Provides FAIRtax promotional materials with authorized AFFT logos.

- Do your shopping, save money and support the AFFT

AFFT National LOGO Store

THE FAIRTAX® LOGO STORE

SUPPLYING EDUCATIONAL/PROMOTIONAL ITEMS

Click here to visit the FAIRtax℠ Store.

Thank You For Opening The FAIRtax Chronicles, Our Sponsored Mailings

We plan to do several of these mailings each month. If you take a minute to open the sponsored emails and click through to the website, you are making an in kind contribution to AFFT. It is not required to actually make a purchase, but your minute of time will ensure that AFFT is paid ever larger amounts from people paying for us to send their offers to our supporters.

Again, we are making every effort to ensure that we work with only reputable companies. If you feel that any FAIRtax-sponsored email is objectionable, please email us at info@fairtax.org and tell us why. You can also opt to not receive these sponsored email messages but still receive FAIRtax emails.

Thank you for staying FAIRtax strong!