On January 1, 1863, President Abraham Lincoln signed the Emancipation Proclamation which officially ended slavery in the Confederate states that were still in rebellion. This fulfilled the promise made in the preliminary proclamation that was issued in September of 1862. While still leaving slavery alone in the states not aligned with the Confederacy, it labeled the rebellious states as fighting to protect slavery—not just to be independent.

While certainly not the same as repealing slavery, by insisting that the existing income tax/payroll tax system be repealed and replaced by the FAIRtax, President Trump will free the American people from the economic and personal freedom oppression of the income tax.

The Biggest Obstacle To Real Tax Reform

In D.C., the present income tax/payroll tax system is seen as a real benefit to staff, Members of Congress and to lobbyists. Because the present tax system allows Congress to pick winners and losers, all of the affected groups have a strong interest in either acquiring or retaining a benefit that allows the groups to pay less taxes.

Russell Long was the Senate Finance Committee Chairman when the 1986 Tax Reform Act was passed. He was besieged by people wanting their special deductions protected. He said, “A tax loophole is something that benefits the other guy. If it benefits you, it is tax reform.”

Often people assert that it is wrong for someone to receive public funds if they are not working from people who are working. They say it is unfair. However, many of these same people will have a different view when it comes to paying less taxes on the same amount of money than another because of a special tax deduction. Why is this not unfair? According to the Center for Responsive Politics, more than 1,500 different interest groups paid millions to lobby Congress on 2016 tax reform proposals alone.

These people justify their lower tax bill in many ways. Some of these groups are trying to pay less taxes because they see this as a way of keeping their total costs lower and making them more able to compete. This means that they can continue to employ people and stay in business. Other groups see lower taxes as more money in their pockets or in the pockets of their shareholders.

There seems to be a blind spot when it comes to “tax welfare.” Tax welfare is where one group is able to pass their tax obligation to another through tax deductions.

Each time Congress has discussed tax reform, the various groups have paid their lobbyists well to persuade Congress to either retain or provide tax benefits. If you look at the larger lobbying firms, you will find that they have a number of former Members of Congress, former Congressional staff or past officials from past administrations—all of whom are being paid very high wages.

If you need access to the Congressional staff, then who better than someone who used to work with them? If you need access to a Member, then who better than a former Member? To the present Congressional staff and current Members, it is understood that they may want to move to a job with the lobbying firm when they leave Congress and so they are even more likely to take the meeting and “help out” the lobbyist if they can.

In addition, the lobbying firms can arrange for large donations to the present Member’s campaign fund. This helps ensure that Congressional incumbents seldom are defeated when they run for re-election.

Draining the Swamp

No politician is going to say that they don’t want to replace the present income tax/payroll tax system. They are going to insist that they only want to do what is in the best interest of their constituents.

They will admit that the present system:

- Is too complex

- Harms the economy

- Costs almost $500 billion per year in compliance costs

- Penalizes work and savings

- Is being more and more evaded and putting the tax burden on people who do pay their taxes

- Encourages companies to move overseas

- Favors imports over U.S. products

- Reduces U.S. exports and costs jobs

- Must be enforced by the IRS

However, they insist that they can correct all of the above problems and yet keep the present income tax/payroll tax system. Delusional, yes, but totally predictable. These politicians know that it may take a year or so, but soon the lobbyists will be back and the money will be back. They know that, like in 1986, they can get lots of groups who are willing to pay large amounts of money to “fix” the income tax code. Most of this will be done in back rooms and few of us will ever even see the “fix.”

Conclusion

The only way that this corrupt system will be changed is if the income tax/payroll tax system is totally abolished and replaced with the FAIRtax. All of the other “reforms” are going to need the IRS to enforce. If you cut the top off the weed in your yard, it will grow back.

Kevin Brady, the Chairman of the House Ways And Means Committee, has been a co-sponsor of the FAIRtax since it was introduced. Chairman Brady recently said, “Here's my thinking: Since tax reform only occurs once a generation, let's not tweak what we have and call it a day.”

President-elect Trump is not part of the D.C. establishment and owes them nothing. He knows that you have to look and not just listen. He can see that Chairman Brady’s definition of reform is not really reform but akin to cutting off the top of the weed.

Vice President-elect Mike Pence and Governor Mike Huckabee know the truth, and all of us must join them to persuade Mr. Trump that he must use his ability to reach the people to force Congress to really reform our tax system by passing the FAIRtax.

YOUR CHANCE TO BRING ABOUT REAL TAX REFORM

We must be able to ensure that our message is clearly heard not only by Congress but also by President-elect Trump. To do this we need your help.

By contributing (investing) $10.40 per month, you help provide a financial base to AFFT. If you can make larger contributions (investments) these will be used not for salaries, as we are all volunteers, but for the needed updates to our economic studies which will be vital in 2017.

Please go to this link to invest in AFFT and in your and your family’s future.

Second, go to the Trump Transition and tell them why you want FAIRtax here.

New FAIRtax Book

AMERICA’S BIG SOLUTION - An Introduction to the FAIRtax

You can help introduce someone to the FAIRtax by informing them of this book. As the title indicates, it is an introduction to the FAIRtax and is directed toward people who may have heard of the FAIRtax but are not really sure of just what it is. Written by Florida volunteer Terry Tibbetts, the book offers a light hearted approach to a serious subject, reforming the federal tax system. America’s Big Solution gives the reader enough information to get them started in their examination of the most thoroughly researched tax reform proposal our country has ever seen. “ABS” is intended for people who may not be attracted to social media for all the latest news and would like to gather their information in a more traditional form that is not limited to a 140 character “tweet” or a Facebook post.

You can find America’s Big Solution on the three most popular platforms -- Amazon, Barnes & Noble and the Apple iBook Store. To purchase the electronic form for the Amazon Kindle or the print form, go to this website. To find it for your Barnes & Noble Nook, go here. And if you’re an Apple user, go to the iBook store at this site. The print version (only available at Amazon) is $9.25 whereas the electronic versions are all priced at $2.99. (Apparently electrons are less expensive than paper and ink!) All royalties go to Americans For Fair Taxation.

Please share this information with everyone you know. The more people know about the FAIRtax, the easier it will be to steer Congress into the only REAL tax reform proposal on the table at this time.

AFFT National LOGO Store

THE FAIRTAX® LOGO STORE

SUPPLYING EDUCATIONAL/PROMOTIONAL ITEMS

New Arrival

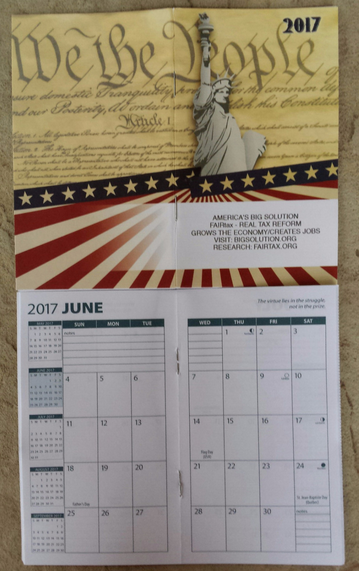

2017 America’s Big Solution Pocket Calendars

THE TIME TO GIVEAWAY A FAIRTAX PLANNER IS NOW !!! WHEN SUPPORTERS START TO USE OUR PLANNER, IT BECOMES THERE GO-TO CALENDAR FOR THE REST OF THE YEAR CONTINUOSLY REMINDING THEM OF THE FAIRTAX.

The 2017 FAIRtax℠ monthly pocket/purse planner has the following information on the cover:

AMERICA’S BIG SOLUTION

FAIRtax – REAL TAX REFORM

GROWS THE ECONOMY/CREATES JOBS

VISIT: BIGSOLUTION.ORG

RESEARCH: FAIRTAX.ORG

Record your event dates per month. Also includes space for personal info plus holiday dates, time zones, metric conversion charts and a 5” ruler. Size 3.5’ x 6”. Great for giveaways. We are offering these new 2017 pocket planners at 10 units per dollar. We only have 2,000 units in inventory, so get your supplies soonest. Order as many packs as you need.

WE CONTINUE TO OFFER OUTSTANDING STORE BOGO’S

PLUS 25% DISCOUNT ON ALL BANNERS

COMING SOON **** FAIRtax℠ Vehicle SUNSHADES **** Don’t miss this one!!!!

When visiting the Store, don’t forget to order a supply of FAIRtax℠ Palm Cards AND the new FAIRtax Informational Business Card. Besides handing out palm cards and info Business Cards at meetings and events, whenever you send mail through the post office, including a few FAIRtax℠ informational Palm Cards and Business Cards in your envelope. And don’t forget some FAIRtax stickers for the outside of your postal envelopes – all are available at the your FAIRtax Store.

Please take a moment and visit our store by clicking here.

Free iPhone & Android Apps for FAIRtax Power Radio

Who are The FAIRtax Guys? This VIDEO will give you an idea. It is Bob & Ron’s mission to save the entire country from the disastrous federal income tax and the criminal enterprise known as the IRS. In order to do that, we must figure out how to get our message to Donald Trump. Once that is accomplished, we must be sure that all Americans understand the value of the FAIRtax, the only REAL tax reform in Congress.

This is the purpose behind FAIRtax Power Radio, a weekly 30 minute podcast which you can listen to online or download for free. The reach of FTPR has recently expanded to include iHeart Radio along with our other major platforms, iTunes and Spreaker.com

And now, FAIRtax Power Radio has free apps for the iPhone and Android. Just go to your app store, look for “FAIRtax Power Radio” and download the free app. When you open the app, all of our episodes are right there for you to listen to whenever you wish.

Also, stay tuned for information on our next Facebook LIVE event.

Be part of the solution. Listen to the FAIRtax Guys and share this info with others.

Links for Further Information

Please, if you'd like to keep studying and promoting the FAIRtax, make yourself familiar with the links below. We always do our best to keep our AFFT community up to date, and you can stay ahead of the curve using these convenient sites.

- The website of Americans for Fair Taxation

- The FAIRtax website at which you can get involved to help make it happen.

- The Facebook page for Americans for Fair Taxation

- The Facebook page for The FAIRtax Guys

- The Twitter page for Americans for Fair Taxation

- PopVox - Connecting people and lawmakers for more effective participation and better governing

- YouTube channel for AFFT

- Provides FAIRtax promotional materials with authorized AFFT logos.

- Do your shopping, save money and support the AFFT

Thank You For Opening The FAIRtax Chronicles, Our Sponsored Mailings

We plan to do several of these mailings each month. If you take a minute to open the sponsored emails and click through to the website, you are making an in kind contribution to AFFT. It is not required to actually make a purchase, but your minute of time will ensure that AFFT is paid ever larger amounts from people paying for us to send their offers to our supporters.

Again, we are making every effort to ensure that we work with only reputable companies. If you feel that any FAIRtax-sponsored email is objectionable, please email us at info@fairtax.org and tell us why. You can also opt to not receive these sponsored email messages but still receive FAIRtax emails.

Thank you for staying FAIRtax strong!