On January 9, 1493, Christopher Columbus was sailing past the Dominican Republic and famously entered in his log that he saw three mermaids. No one knows when stories about the existence of half-female and half-fish creatures, called mermaids, first started but their existence was commonly believed in Columbus’ time and frequently reported on ship’s logs.

Columbus wrote that the mermaids were “…not half as beautiful as they are painted.” There was a good reason for this--Columbus later discovered that these “mermaids” were really manatees.

Congress is looking at making changes to the present income tax/payroll tax system. They call their proposals to “change” the income tax system, “tax reform.” Like Columbus, they are seeing what isn’t there. Instead of confusing manatees with unattractive mermaids, Congress is confusing what they are proposing, “change” for “reform.”

According to the Merriam Webster dictionary, change is defined as:

1: the act, process, or result of changing: as

a : alteration <a change in the weather>

b : transformation <a time of vast social change> <going through changes>

c : substitution <a change of scenery>

Reform is defined as:

1: amendment of what is defective, vicious, corrupt, or depraved

2: a removal or correction of an abuse, a wrong, or errors

However, unlike Columbus, their mistake will not be just a mistake that brings smiles today. The mistake Congress is making by not really changing the method used to fund the federal government, the income/payroll tax system, is much more serious.

The Consequences of Calling “Change” “Reform”

Speaker Ryan and Chairman Brady are wasting a once in a generation opportunity to actually fix the broken income/payroll tax system. The idea of just making changes to the present system will:

- Not stay changed for even five years

- Not allow any border adjustable benefits because it will be refused by the World Trade Organization

- Not reduce the growing evasion problems

- Not reward American companies for keeping jobs in the U.S.

- Not reduce the continued and growing evasion of the income/payroll tax

- Not reduce but greatly increase profits to lobbying firms

- Not remove the IRS from our lives

- Not provide relief to small business

- Not reduce compliance costs

These “changes” that Speaker Ryan and Chairman Brady are promoting are like the person who broke his arm going to the doctor and complaining about a pain in his arm. The doctor is busy and just gives him a strong pain-killer prescription. Until the prescription runs out, the person may feel better but the broken arm is still there. The only long-term solution is to set the broken bone.

The only way to “fix” the income tax/payroll tax system is to tear it out by its roots and replace it with the FAIRtax.

Common Sense

It was also on January 9, but in 1776, that Thomas Paine published Common Sense. This 47- page pamphlet sold over 500,000 copies and is widely credited with uniting Americans for independence. It was so effective that General Washington ordered it to be read to his troops.

Some of the statements in Paine’s book are applicable today and, in particular, to the need to not change but reform the present income tax/payroll tax system. Paine said, “A long habit of not thinking a thing wrong, gives it a superficial appearance of being right, and raises at first a formidable outcry in defense of custom. But the tumult soon subsides. Time makes more converts than reason.”

Just because the income tax/payroll tax system has been in place since 1913 doesn’t mean that it is working today. As Albert Einstein said, “Insanity: doing the same thing over and over again and expecting different results.”

Conclusion

Speaker Ryan, Chairman Brady and the whole of Congress should also be aware of this excerpt from Common Sense:

“Men who look upon themselves born to reign, and others to obey, soon grow insolent; selected from the rest of mankind their minds are early poisoned by importance; and the world they act in differs so materially from the world at large, that they have but little opportunity of knowing its true interests, and when they succeed to the government are frequently the most ignorant and unfit of any throughout the dominions.”

If Congress continues to try to mislead the American people and call the changes they propose to the tax code“reform”, then what are their true interests? Ryan and Brady are both intelligent and nice people and this is why their position is hard to understand. Please remember what Thomas Edison said, “What you are will show in what you do.”

We need to write and call our Members of Congress and demand that they “reform” the income tax/payroll tax system and replace it with the FAIRtax!

YOUR CHANCE TO BRING ABOUT REAL TAX REFORM

We must be able to ensure that our message is clearly heard not only by Congress but also by President-elect Trump. To do this we need your help.

By contributing (investing) $10.40 per month, you help provide a financial base to AFFT. If you can make larger contributions (investments) these will be used not for salaries, as we are all volunteers, but for the needed updates to our economic studies which will be vital in 2017.

Please go to this link to invest in AFFT and in your and your family’s future.

Second, go to the Trump Transition and tell them why you want FAIRtax here.

New FAIRtax Book

AMERICA’S BIG SOLUTION - An Introduction to the FAIRtax

You can help introduce someone to the FAIRtax by informing them of this book. As the title indicates, it is an introduction to the FAIRtax and is directed toward people who may have heard of the FAIRtax but are not really sure of just what it is. Written by Florida volunteer Terry Tibbetts, the book offers a light hearted approach to a serious subject, reforming the federal tax system. America’s Big Solution gives the reader enough information to get them started in their examination of the most thoroughly researched tax reform proposal our country has ever seen. “ABS” is intended for people who may not be attracted to social media for all the latest news and would like to gather their information in a more traditional form that is not limited to a 140 character “tweet” or a Facebook post.

You can find America’s Big Solution on the three most popular platforms -- Amazon, Barnes & Noble and the Apple iBook Store. To purchase the electronic form for the Amazon Kindle or the print form, go to this website. To find it for your Barnes & Noble Nook, go here. And if you’re an Apple user, go to the iBook store at this site. The print version (only available at Amazon) is $9.25 whereas the electronic versions are all priced at $2.99. (Apparently electrons are less expensive than paper and ink!) All royalties go to Americans For Fair Taxation.

Please share this information with everyone you know. The more people know about the FAIRtax, the easier it will be to steer Congress into the only REAL tax reform proposal on the table at this time.

AFFT National LOGO Store

THE FAIRTAX® LOGO STORE

SUPPLYING EDUCATIONAL/PROMOTIONAL ITEMS

New Arrival

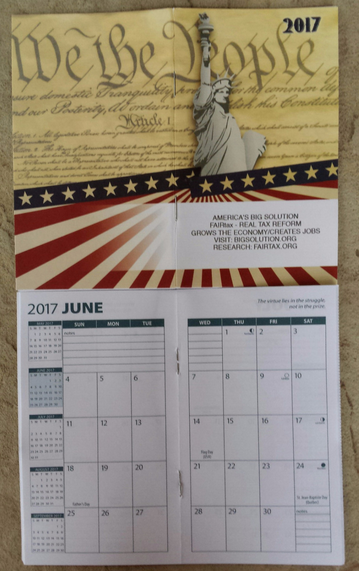

2017 America’s Big Solution Pocket Calendars

THE TIME TO GIVEAWAY A FAIRTAX PLANNER IS NOW !!! WHEN SUPPORTERS START TO USE OUR PLANNER, IT BECOMES THEIR GO-TO CALENDAR FOR THE REST OF THE YEAR CONTINUOUSLY REMINDING THEM OF THE FAIRTAX.

The 2017 FAIRtax℠ monthly pocket/purse planner has the following information on the cover:

AMERICA’S BIG SOLUTION

FAIRtax – REAL TAX REFORM

GROWS THE ECONOMY/CREATES JOBS

VISIT: BIGSOLUTION.ORG

RESEARCH: FAIRTAX.ORG

Record your event dates per month. Also includes space for personal info plus holiday dates, time zones, metric conversion charts and a 5” ruler. Size 3.5’ x 6”. Great for giveaways. We are offering these new 2017 pocket planners at 10 units per dollar. We only have 2,000 units in inventory, so get your supplies soonest. Order as many packs as you need.

WE CONTINUE TO OFFER OUTSTANDING STORE BOGO’S

PLUS 25% DISCOUNT ON ALL BANNERS

COMING SOON **** FAIRtax℠ Vehicle SUNSHADES **** Don’t miss this one!!!!

When visiting the Store, don’t forget to order a supply of FAIRtax℠ Palm Cards AND the new FAIRtax Informational Business Card. Besides handing out palm cards and info Business Cards at meetings and events, whenever you send mail through the post office, including a few FAIRtax℠ informational Palm Cards and Business Cards in your envelope. And don’t forget some FAIRtax stickers for the outside of your postal envelopes – all are available at the your FAIRtax Store.

Please take a moment and visit our store by clicking here.

FAIRtax Power Radio

With only days until the new administration is installed, how will Americans influence Congress and the Trump team to take a serious look at the FAIRtax - the only REAL tax reform proposal in Congress at this time. What role will the FAIRtax volunteers play and what can the readers of FAIRtax Friday do to move the process along.

In the weekly episodes for FAIRtax Power Radio, The FAIRtax Guys, Bob and Ron, discuss the many problems with the current federal income tax, the solution to all those problems, the FAIRtax and how we are going to force Congress to adopt the FAIRtax as the replacement for the current failed income tax. Each episode is a podcast that you can listen to online or download and listen to later. A new episode is posted every Friday morning. You can find these free podcasts on Spreaker, iTunes and iHeart Radio.

Want to listen to this show on-the-go? Download the free apps for iPhone or Android now on your device now. Just look for FAIRTAX POWER RADIO in your app store.

Stay on top of these developments and learn how you can help. Listen to FAIRtax Power Radio every week and refer your friends to our show. And stay tuned for information on our next Facebook LIVE event.

Links for Further Information

Please, if you'd like to keep studying and promoting the FAIRtax, make yourself familiar with the links below. We always do our best to keep our AFFT community up to date, and you can stay ahead of the curve using these convenient sites.

- The website of Americans for Fair Taxation

- The FAIRtax website at which you can get involved to help make it happen.

- The Facebook page for Americans for Fair Taxation

- The Facebook page for The FAIRtax Guys

- The Twitter page for Americans for Fair Taxation

- PopVox - Connecting people and lawmakers for more effective participation and better governing

- YouTube channel for AFFT

- Provides FAIRtax promotional materials with authorized AFFT logos.

- Do your shopping, save money and support the AFFT

Thank You For Opening The FAIRtax Chronicles, Our Sponsored Mailings

We plan to do several of these mailings each month. If you take a minute to open the sponsored emails and click through to the website, you are making an in kind contribution to AFFT. It is not required to actually make a purchase, but your minute of time will ensure that AFFT is paid ever larger amounts from people paying for us to send their offers to our supporters.

Again, we are making every effort to ensure that we work with only reputable companies. If you feel that any FAIRtax-sponsored email is objectionable, please email us at info@fairtax.org and tell us why. You can also opt to not receive these sponsored email messages but still receive FAIRtax emails.

Thank you for staying FAIRtax strong!