The following article is written by Chuck Bailey. He and Mary Lynn, his Wife, have been heading up the Alabama State FAIRtax organization and Chuck is on the AFFT Board Of Delegates. After reading how about checking out our new webpage dedicated to Alabama.

Yes! Getting A Tax Reform Bill Passed Is Like Making Sausage

In 2015, my Wife and I had been FAIRtax Volunteers in Alabama for 10 years. At that point in time, we were wondering if the national bill could be helped along to enactment if a couple of states would enact state tax systems modeled on The FAIRtax. The consumption tax word was being spread around the state in meetings with church organizations, civic clubs, tea parties, political clubs …. everywhere people invited us to tell our story.

As it happens, Alabama State House Rep. Mike Holmes (Wetumpka) at the same time was offering the “Bold Tax Reform For Alabama” as a conservative alternative to previously released plans. His proposal would have required a constitutional amendment and would include repealing the state income tax. In return, the state sales tax would be expanded to include services, increased from 4% to 6.5% and most exemptions would be removed. Plus some other additional features.

After some thought, we realized Rep. Holmes was on a similar path trying to accomplish the same result as we were at Alabama FAIRtax. But, he didn’t have the research & development available we already had. So, in the summer of 2016 a meeting was conducted with him and other legislators and determined our efforts should be combined to accomplish our mutual goal of totally replacing the current income-sales tax system with a single rate consumption tax. It was decided The FAIRtax Plan was the best model to use and efforts began to define a bill to determine a revenue neutral single rate consumption tax system for Alabama.

In parallel at the time, Georgians For Fair Taxation had their bill written by the coauthor of the national bill and the rate study conducted by the Beacon Hill Institute, the same group who defined the national rate using their certified Computable General Equilibrium (CGE) Model to accomplish "dynamic" tax studies. We followed suit and acquired the services of both, receiving the draft consumption tax rate study in May-2016 and the draft bill in December-2016. Legislative activity began in February-2017, but due to hot button issues in 2017 and 2018, our activity was rescheduled for 2019. After an update to the bill and rate studies in 2019, introduction was once again delayed due to the crowded legislative schedule.

At last Sunday’s Mass, we were reminded “If you ask, you shall receive. Seek and you shall find. Knock and the door will be opened to you”. For prayers to be answered, you must be persistent in prayer. We were and are persistent!

In the latter part of this year’s legislative session, the bill and rate study cleared the Legislative Services Agency but was too late to introduce. Everything was set at the end of the session, so to be ready for next year, Rep. Holmes pre-filed the bill on June 4th as The “Alabama Economic Freedom Act” (AEFA) and it was assigned bill# HB4. Since the Act abolishes the current income and sales tax laws, a Constitutional Amendment repealing applicable sections of the Alabama Code of 1975 must be voted into law by Alabama voters. The Constitutional Amendment was assigned bill# HB3. The plan is to move HB4 through to enactment early in the legislative session next year so HB3 can be on the ballot next fall. Still praying!

So, what do we get when the AEFA is passed next Spring?

- The first thing to happen is the old tax law is repealed and replaced with a single rate consumption tax, only on new goods and services purchased at retail sales for personal use.

- Individuals no longer have to waste their limited and therefore, precious time on collecting receipts, filling out complicated forms and reporting income to the state.

- Corporations no longer have to waste time on collecting receipts, filling out complicated forms and reporting income to the state.

- There are no more “B2B” (business-to-business) taxes since taxes on labor and all corporate income taxes are eliminated.

- The tax base more than doubles to afford a lower revenue neutral consumption tax rate.

- Enforcement drastically shrinks from over 2,300,000 income tax filers to about 60,000 retailers.

- The Income Tax Division is eliminated within 3 years and all income tax documentation is destroyed.

- Tax compliance costs will plummet.

The new system is:

- Simple, transparent, efficient and fair as retailers collect the tax only at the point of retail sales and are reimbursed to do so.

- Like the national bill, the AEFA has a pre-bate based on the HHS poverty guidelines.

- The pre-bate is applied by family size, not income.

- The single rate consumption tax is 8.03%, but is offset by the pre-bate to result in a lower overall cost to all eligible Alabama residents, especially lower wealth Indivduals.

- Spending at poverty level is tax free.

- Spending at twice the poverty level is effectively a 4% rate, the current sales tax rate.

- Spending has to be in the millions of dollars for any family size before paying a full 8.03% on spending.

- As with the national bill, the pre-bate is a cornerstone of fairness built into the system.

So far, we have very good support from legislators with several of them contributing funds to pay for writing the bill and conducting the rate study. As alluded to earlier, this effort is privately-funded and Constituent supported by Alabama FAIRtax volunteers. All bill writing and studies have been funded by volunteer donors from Alabama including the legislators.

Finally, as with the national FAIRtax effort, the “Alabama Economic Freedom Act” has experienced the normal pushback from individuals who really haven’t studied the bill and haven’t gone through the simple pre-bate process to see how it actually works. The typical reactions are, “it won't ever happen!”, “oh my gosh, you’re going to add 8.03% to the tax we’re now paying?” or “I live in a county that has a local tax lower than those around me. I’ll be negatively impacted by the AEFA.”

They don’t actually know what is going on among the legislators or how many have already said they’ll vote for the bill in the House and Senate, nor do they know the positive reception among the administration. As we approach next year’s legislative session in the Spring, most WILL find out.

And, as discussed above, Individuals & Families have to spend upwards to 128x their associated poverty level before actually paying the full rate of 8.03% on their discretionary spending. This pre-bate fact overrides the local tax differential argument. If every legal Alabamian paying the tax has applied for and is receiving the pre-bate purchases a new product or service, their out of pocket taxes will be less because abolishing the current, costly, tax compliance system is significantly reduced and the tax base broadened by over 2x the current level.

The AEFA isn’t complicated. The current system is! You can’t be any more Uncomplicated than “you buy a new product, you pay the tax, you’re done with paying your Alabama taxes until you purchase again. You buy a service, pay the tax, Done!” The retailer collects the tax, remits it to the state - literally on a single page form - and is reimbursed for collection efforts. The AEFA is not complicated!

To sum up, The "Alabama Economic Freedom Act" has been pre-filed and assigned to committee in the Alabama House. A significant number of representatives already support the bill. There is also a Senate sponsor who has the support of other Senators. It is defined to totally repeal the current state income tax, the state sales tax and all city and county sales taxes and replacing it all with a single rate consumption tax. Rep. Holmes is leading the effort to pass HB4 through the House early in next year’s legislative session to allow passage in the Senate, signing into law by the Governor and a vote on the associated Constitutional Amendment HB3, in time for next year’s national general election. Voting to change the Constitution to allow the AEFA would allow the switch to the consumption tax on January 1, 2021.

Yes! Getting a true tax reform bill passed in the state legislature is like making sausage! It takes a lot of time, work and prayer. And yes, we’re still praying!

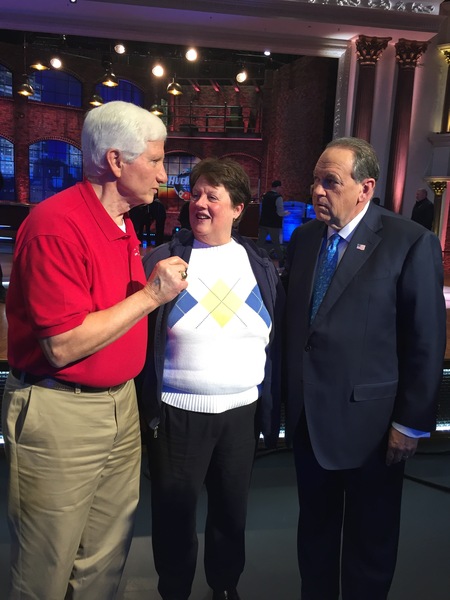

Rep. Mike Holmes, Alabama House District 31

Elmore County, Wetumpka, AL 36093

Rep. Mike Holmes began his 1st full term in the Alabama House Of Representatives 11/4/2014. He was born in Crenshaw County. After completing public education he attended Troy State University earning a B.S. degree and attended graduate school at Penn State University. Rep. Holmes is a former high school teacher and coach who went into agricultural sales, marketing, and operations. Eventually he became the chief executive of 2 different agri-business corporations. He is also an entrepreneur having founded and successfully operated a Real Estate Brokerage, specializing in land and small business acquisitions. Rep. Holmes is married to the former Shirley Russell. They have 2 children and 4 grandchildren.

Chuck & Mary Lynn Bailey - FAIRtax Volunteers, Alabama State Director

irlaserman@sprynet.com 256-479-4350

Chuck Bailey retired from The Boeing Company after a career in electro-optics engineering including Rockwell International and the U.S. Army Missile Command. He also retired from the Air National Guard as a Lt. Col. after 4 years active duty and 26 1/2 years in the ANG. The 1st 10 of those 30 1/2 years were as an enlisted man, the remainder as an officer. Most of the retirement time has been spent actively pursuing enactment of “The Fair Tax Act”, commonly known as The FAIRtax, currently in the U.S. House as H.R. 25 and also The "Alabama Economic Freedom Act” - HB4, in the Alabama State House. He and his Wife Mary Lynn have 3 grown children and 5 grandchildren.

Conclusion

The “Alabama Economic Freedom Act” will demonstrate to everyone how implementing The FAIRtax at the state level will help Alabama and the fact its gaining traction sends waves of anxiety to The Swamp in D.C. How could these upstarts in Alabama actually threaten us? Don’t they understand we know best? Alabama is demonstrating We The People make the correct choice.

The Alabama and national FAIRtax are going to help everyone!

Anyone who truly cares about the American people say, “It is time to pass The FAIRtax, the only “Fair Tax”!

The author George Bernard Shaw said, "You see things; and you say “Why”. But I dream things that never were; and I say “Why Not”.

We say to you President Trump, “Embrace The FAIRtax and real tax reform! Stand up to The Swamp. They will oppose you anyway because they see you as a threat. What have you got to lose?”

The truth is the truth. Remember, if we don't continue to tell the truth and demand a change, then this quote from George Orwell's 1984 may foretell our children's future: “If you want a picture of the future, imagine a boot stamping on a human face—forever.”

Take Back America Again! Pass The FAIRtax Now!

FAIRtax Online Resources

Americans For Fair Taxation - Home Page

Americans For Fair Taxation - Facebook Page

Americans For Fair Taxation - YouTube Channel

Americans For Fair Taxation - Twitter Page

Americans For Fair Taxation - Chairman's Report Podcast on Spreaker

Americans For Fair Taxation - Chairman's Report Podcast on Apple

Americans For Fair Taxation - Chairman's Report Podcast on iHeart Radio

Official FAIRtax Logo Store

The FAIRtax Guys - Home Page

The FAIRtax Guys - Facebook Page

The FAIRtax Guys - YouTube Channel

PopVox - The People’s Voice On All Things Legislative

Read Evasion Study Summary

The FAIRtax Guys

Ron Maiellaro & Bob Paxton perform their FAIRtax Power Digital-TV Show & Podcast. When the show streams to Facebook, The FAIRtax Guys plus a few AFFT experts are responding “live” to your comments and questions. A free app is available for iOS and Android.

Digital TV: Tues-8PM-ET Americans For Fair Taxation - Facebook Page

Digital TV: Wed-7PM-ET The FAIRtax Guys - YouTube Channel

Podcasts: Fri-6AM-ET Posted on Spreaker, Apple Podcasts & iHeart Radio.

Digital TV & Podcasts are available on The FAIRtax Guys - Past Shows

This week's Episode #171 - "Slogans, Grassroots & The Finer Points Of The FAIRtax"

Click "Here" for your last chance to email us your best IRS slogan before we turn over the entries to our panel of judges. The winner will receive something from The FAIRtax Logo Store

In the Grassroots Corner, Jim Bennett reports on the efforts by AFFT to provide regional FAIRtax leaders who can help other FAIRtax supporters to make an impact in their area.

What are some of the questions you encounter when you first introduce someone to The FAIRtax. It’s back to basics in this episode of FAIRtax Power Radio.

- What’s the difference between The FAIRtax and the flat tax?

- Would you like to keep more of your earnings?

- Will The FAIRtax support Social Security & Medicare?

- What is the Pre-bate and how will it help Americans?

- Will I have to share all my family financial info with the government?

- How can I support The FAIRtax?

We try to provide something in every episode to help our viewers and listeners become educated about The FAIRtax. So please do what you can to help us create a groundswell of support for The FAIRtax across the entire country. Enjoy this episode and please Share it with others you know.

What Can Each Of Us Do?

Call the local and DC offices of your Representative and 2 Senators. Use the following script:

- I am sure Representative ____ or Senator ____ is in favor of everyone obeying the income tax laws.

- After they assure you their boss is not in favor of anyone breaking the law, ask if they are aware of the Cebula study showing $9 trillion of evaded income-payroll taxes over the next 10 years.

- Since most will say they don’t believe their boss has seen the study, drop off a copy, email a copy or click Read Evasion Study Summary and copy/paste the link into an email.

- Say you are going to call back in a week and ask what the Representative or Senator is going to do to stop this evasion.

- In a week, call back and ask specifically what the Representative or Senator is going to do to enforce the law.

- They probably will say their boss believes simplifying the income tax will handle the problem.

- Explain, when people evade income taxes, they are also evading the 15.3% payroll/Medicare tax and state income tax. So, it’s unlikely they are going to pay 30-40% when they were paying 0% because they have already decided it’s okay to cheat.

- Say, the only way to reduce evasion is to increase by tens or hundreds of thousands the number of comprehensive IRS audits done each year.

- Point out Evaders do not self-identify by putting an “E” on their income tax return.

- 80% of the people likely to be audited are trying to comply, but they will be forced to endure these IRS audits as well.

- Ask if the Member is in favor of this?

- If they say no, then ask again how the Member proposes to stop people breaking the income tax laws.

- Then explain the way to handle evasion without unleashing the IRS audits is The FAIRtax.

- If you meet with your Representative or attend a town hall and ask these questions, you will be even more effective.

American's Big Solution - The FAIRtax Primer America Needs

Hard to believe but there still are people who have not heard of The FAIRtax. For those people, America’s Big Solution provides a starting point in their study of The FAIRtax and is meant for any age.

America’s Big Solution is an introduction to The FAIRtax written by Terry Tibbetts, author of “A Spartan Game: The Life and Loss of Don Holleder”, with help from Ron Maiellaro, President The Florida FAIRtax Educational Association. You can buy an electronic version for only $2.99 for the Amazon Kindle, the Barnes & Noble Nook and Apple iOS. You can purchase a print copy at the same Amazon link above for $9.25.

Thank You for Opening The FAIRtax Chronicles, Our Sponsored Mailings

We plan to do several of these mailings each month. If you take a minute to open the sponsored emails and click through to the website, you are making an in kind contribution to AFFT. It is not required to actually make a purchase, but your minute of time will ensure AFFT is paid ever larger amounts from people paying for us to send their offers to our Supporters.

Again, we are making every effort to ensure we work with only reputable companies. If you feel any FAIRtax-sponsored email is objectionable, please email us and tell us why. You can also opt to not receive these sponsored email messages but still receive FAIRtax emails.

Thank you for staying FAIRtax strong!

Respectfully,

Steve Hayes

Chairman, Americans For Fair Taxation